This market, as we anticipated on December 11th, remains in a volatility storm. It’s been crushing investors large and small alike. Even the so-called “smartest guys in the room†are struggling:

We came down, despite the holiday trade issue, on the side of the bulls earlier this week. We believe that had it not been for the awful Apple news and what it portends for other tech companies as well, the market would have attempted to continue to rally. The news can always be spun either way in most cases but today’s news is being received well thus far and as we write the SPYs are making their way above the critical $250.00 level. That could be a very good sign if it holds.

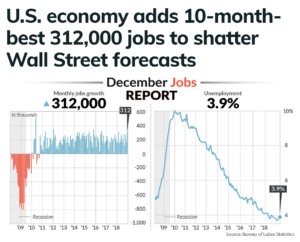

Jobs performance was strong in December and FED Chairman Powell seems to be indicating that he’s starting to “get it.â€Â Thus, maybe, just maybe, he won’t raise rates and push equity investors off the cliff. We’ll see, but for now, the instant comeback we’re seeing, which could be ephemeral mind you, is encouraging.

TGT hasn’t really done much, which can also be said for the SPYs on a “net basis.â€Â In other words, prices aren’t much different than we analyzed them after Monday’s action and prior to the New Year’s holiday. FIVE on the other hand, this week’s other bull name but as a mention, has powered up to its 150 SMA near $108.60, which is a nice move considering the market’s performance yesterday. If it can continue and pop through there, then $110.00ish becomes our next level of focus. Naturally and as we explained in the webinar, we preferred FIVE’s technical complexion over TGT’s but the options liquidity in it wasn’t as solid. The 3rd level up for it is $113.40 where it would complete a gap fill.

We did scan around for more bears but elected to sit tight and not get drawn into fresh bear trades despite yesterday’s weakness. Normally we’d have dove in, but we sensed that the overall market wasn’t being punished anywhere near the degree that the Apple ecosystem was and thus we thought it could be news that the larger market would digest quickly and put aside. Fortunately, that’s the case so far because it would have been ugly had we gotten beared-up near yesterday’s lows. This week proves once again how difficult it is to swing trade in a volatility storm. NEWS drives a lot of movement in a hurry and guessing what the NEWS effect will be ahead of time on any given day is nearly impossible. Thus, we refrain from doing so. It’s frustrating as traders to not trade more but it is far worse to get victimized over and over again by news and movement that follows from it that’s only known by the privileged few.